Price

Source: dshort blog, Monthly Moving Averages: January Month-End Update

The large rally in US stocks during the month of January lacked the strength needed to push US stocks into an "invested" position using the Ivy Portfolio system. VTI, the Vanguard Total Stock Market ETF, finished its second month in "cash." Moreover, three of the last four months have signaled "cash" over "invested." Remember in the December Market Update, I suggested not chasing the "invested" signal for VTI. Vanguard FTSE All-World ETF, VEU, has been signaling "cash" rather than invested since the end of May 2018.

As we start February, only two asset classes show "invested" according to the Ivy Portfolio system. Those asset classes are: Vanguard REIT Index (VNQ) and iShares Barclays 7-10 Year Treasury (IEF). Jill Mislinki, writing for the dshort blog at Advisor Perspectives, also reported this month that the 10-month exponential moving average for the S&P 500 signaled "invested." I'm intrigued to see how the markets in February will impact the Ivy Portfolio signals.

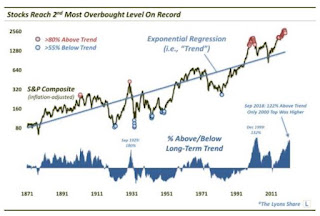

Before we examine sentiment, let's highlight the following graph from Dana Lyon:

Source: Dana Lyon's Tumblr

Mr. Lyon made a regression line on the S&P Composite and then highlighted in red when the market is 80% above the trend line. I recommend you read his entire post. Here is one of the main takeaways from his analysis:

"As it turns out, this past September saw the composite reach 122% above the trend line, i.e., it was 122% 'overbought.' In nearly 150 years, the only months that saw prices more overbought than that were those encompassing the 1999-2000 market top — the most excessive, bubbly top in U.S. market history."Sentiment

Source: CNN Business Fear & Greed Index

This index shifted from "Extreme Fear" at the end of last month to "Greed" as we start February. The seven components of the index breakdown as follows:

3 "Extreme Greed"- Safe Haven Demand, Stock Price Strength, Stock Price Breadth

2 "Neutral"- Market Volatility, Put and Call Options

1 "Fear"- Junk Bond Demand

1 "Extreme Fear"- Market Momentum

Visit CNN Business to learn more about each component.

Will greedy sentiment continue through the entire month of February? I wonder what impact Q4 GDP numbers released in February will have on this picture. Q4 GDP is delayed from its original publication date of January 30, 2019 because of the partial government shutdown. Gross Domestic Product, 4th quarter and annual 2018 (second estimate) is scheduled to be released February 28. We also need to watch February 15, 2019 to see if the partial government shutdown resumes. Remember March brings China/U.S. trade deal deadline on the first and hard Brexit on the twenty-ninth.

Valuation

On January 14, 2019 Mark Hulbert wrote an opinion piece for Market Watch titled, 6 reasons why stocks are still overvalued — even after this recent correction, which he summarized in the following chart:

Source: MarketWatch

To quote Mr. Hulbert, the following is how he described this chart:

• The price/book ratio, which stands at 3.0 to 1. This ratio is lower than that at 22 of the 29 major market tops since 1929.

• The price/sales ratio, which stands at an estimated 1.9 to 1. At 18 of the 19 market tops since the mid-1950s, the price/sales ratio was lower.

• The dividend yield, which currently is 2.3% for the S&P 500. At 31 of the 36 bull-market peaks since 1900, the dividend yield was higher.

• The cyclically adjusted price/earnings ratio, which currently stands at 29.0. This is the ratio championed by Yale University’s Robert Shiller. It was lower than where it is today at 32 of the 36 bull-market highs since 1900.

• The so-called “Q” ratio, which is calculated by dividing market value by the replacement cost of assets. According Stephen Wright, an economics professor at the University of London, and Andrew Smithers, founder of the U.K.-based economics-consulting firm Smithers & Co., the Q-ratio currently is higher than it was at 30 of the 36 bull-market tops since 1900.

• P/E ratio. This is the valuation indicator that is currently painting the least-bearish (most bullish) picture. Perhaps not coincidentally, it is the indicator that is most often quoted in the financial press. Nevertheless, according to data on as-reported earnings compiled by Yale’s Shiller, and based on S&P estimates for the fourth quarter, this ratio currently stands at 18.4 to 1. That’s still higher than 67% of past bull-market peaks.As we've discussed many times, market valuation has no impact on short-term market direction, but does help set long-term expectations for returns.

Summary

We start February with two asset classes, IEF and VNQ, signaling "invested" and VTI, VEU and DBC suggesting "cash" based on the Ivy Portfolio system. Sentiment shifted dramatically from "Extreme Fear" to "Greed" during January. Valuation remains elevated. Can the market stay in an uptrend through the challenges of February and March? In my opinion, the market cannot continue to rocket higher, expect more chop. Let's end this update with a few quotes from John Bogle, who created the first index fund in 1975 and founded Vanguard. He passed away earlier this year at age 89.

"When there are multiple solutions to a problem, choose the simplest one."

"But most short-term renters of stocks are not particularly interested in assuring that corporate governance is focused on placing the interests of the stockholder first."

"In the long run, investing is not about markets at all. Investing is about enjoying the returns earned by businesses."

As always, wise investing my friends.

Please consult a qualified financial advisor before making any investment decisions. This blog is for educational purposes only and does NOT constitute individual investment advice.--------------------------------------------------------

Here's what I've been reading and watching recently:

- Two Out of Three Ain’t (Good): Leading Indicators Falter Again (Schwab)

- The Fed's mysterious pause (WSJ via Fidelity)

- 2018: The Year in Charts (Pension Partners)

- Interview: The Fed, Markets, Growth & Inflation (Reuters via ECRI)

- The World Economy Just Can’t Escape Its Low-Growth, Low-Inflation Rut (NY Times)

- The Trinity Portfolio (Cambria Investments)

- Low carbohydrate diets are unsafe and should be avoided (European Society of Cardiology)

- The Business Cycle: How Does Each Sector Perform? (Schwab)