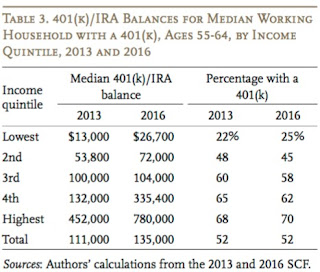

The overall report shows some encouraging trends, however it's disturbing to read the extent of the challenges younger and lower paid workers have accessing defined contribution plans and saving for retirement. The report highlights that the financial services industry working with municipal, state and federal governments need to create more options so fewer working age adults miss out on saving for retirement. Below are two graphics from the report that stood out to me. The first one shows how little the median household has saved for retirement. The second one shows the disparity between high income folks and low income folks nearing retirement. Notice the median household has $780,000 in the top quintile by income compared to $26,700 for the lowest quintile by income.

Please read Alicia Munnell's and Anqi Chen's report. It is full of data points that will help you understand the pitfalls of our current retirement planning system. The current system excludes too many Americans from owning defined contribution accounts; while those that do own those accounts are underfunding them to meet their retirement needs. If you're really interested in how these numbers have changed over time you can compare the report with data through 2016 to their report with data through 2013.