Price

Source: D Short Blog

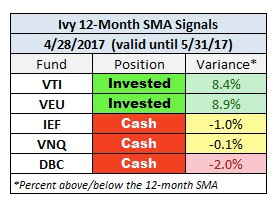

According to the 10 and 12 month moving averages for IEF(bonds), VNQ(REITs), DBC(Commodities), VTI(US stocks), and VEU(foreign stocks) the only two asset classes to be invested in are VTI and VEU. Both VTI and VEU are trading over 8% above their 12-month moving averages, which is exceptional. We went another month without a 5% stock market correction. Please click on the chart below to see the corrections in the market from Yardeni Research:

Source: Yardeni Research, Inc. Market Briefing: S&P 500 Bull & Bear Markets & Corrections.

Sentiment

Source: CNN Money Fear & Greed Index

The CNN Money Fear and Greed index improved from 30 at the beginning of April to the high 40's. It has been hanging around 50, very neutral. The technical index I follow for the S&P 500 created by Recognia shows short term sentiment (2 to 6 weeks) is strong. Mid term sentiment (6 weeks to 9 months) is indicating weak and long term sentiment (9 months to 2 years) is reading neutral. Remember the short term index will fluctuate frequently.

Valuation

Let's turn over today's discussion of valuation to the Oracle of Omaha, this is a link to Buffet's take on valuation from his February 27th interview on CNBC with Becky Quick. He states during the interview: "It's making a terrible mistake if you stay out of a game that you think is going to be very good over time because you think you can pick a better time to enter it." He also discusses valuation in relation to low interest rates and how he believes today's market would look expensive if interest rates were higher.

Summary

The market remains overdue for a 5% or greater correction. The sentiment indicators are neutral. Valuation is expensive and remains only justifiable as long as interest rates remain low. When I look at the main asset classes that can be used to create a diversified portfolio three of the five are reading to stay uninvested (IEF, VNQ, DBC). Overall, I like dollar cost averaging into this market rather than investing a lump sum at one time. Statistically lump sum investing is better than following a systematic investing plan two-thirds of the time. If I was adding a large sum of money to this market, I'd add it in over the next 6 or 12 months gradually turning an all cash portfolio into your target asset allocation plan (while keeping cash available to cover all of your short term spending needs). Please read Nerd's Eye View's article Buying Happiness And Life Satisfaction With Greater Cash-On-Hand Reserves. It asks one fundamental question to start the investing process: how much cash do you need to hold to feel comfortable? Let's end with two Buffett quotes. Two characteristics of successful people include acting with consistency and integrity. Wise investing my friends.

"It is not necessary to do extraordinary things to get extraordinary results."

"It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently."

Please consult a qualified financial advisor before making any investment decisions. This blog is for educational purposes only and does NOT constitute individual investment advice.