Price

Source: dshort blog, Moving Averages: April Month-End Update

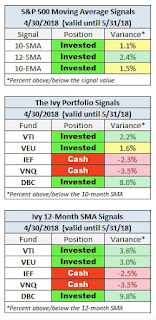

The Ivy Portfolio timing model shows three asset classes (VTI, VEU, DBC) remain invested at the beginning of May and two asset classes (IEF, VNQ) remain in cash. As Jill Mislinski writes at the dshort blog:

All three S&P 500 MAs are signaling "invested" and three of five Ivy Portfolio ETFs — Vanguard Total Stock Market ETF (VTI), Vanguard FTSE All-World ex-US ETF (VEU), and PowerShares DB Commodity Index (DBC) — are signaling "invested".Foreign Developed Markets are the closest to leaving "invested" and going to "cash." We will review this again at the end of May to see if any additional asset classes have moved to cash. In the price section today I'd also like to highlight the following chart from Bespoke Investment Group:

Source: Bespoke Investment Group, The Closer 5/3/18

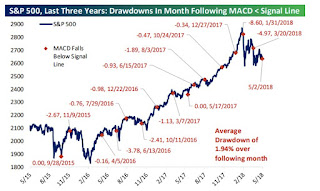

On May 2, 2018, they identified that the MACD fell below the Signal Line for the S&P 500. As the chart above shows, this marks the third time this pattern has been observed in 2018. Bespoke notes the average drawdown over the following month is -1.94%, however the actual results seen since 2015 show a range between 0.00 and -8.60%.

Sentiment

Source: CNN Money Fear & Greed Index

Sentiment has been improving since hitting single digits earlier this year. I'm specifically paying attention to the yield spread component of this index. The spread, or how much extra yield investors require for investing in junk bonds over investment grade corporate bonds, has decreased significantly in the last few weeks. As we start May this index is still reading fear, which begs the question: When will investors feel greedy again?

Valuation

Let's take a slightly different take on valuation today. What if we examine where we are in the market in terms of the level of the VIX.

Source: Episode blog via The Big Picture blog

As Eric Lonergan writes for the Episode blog for M&G Investments:

This latest ‘flash crash’ is a notable event. There have been only three phases in last 25 years when the S&P500 has moved this rapidly in this short a period of time, a fact drawn to my attention by my perceptive colleague, Marc Beckenstrater (see figure 1). Similar moves in the last 25 years have coincided with genuine events. The Asian crisis, the tech bust, and the GFC. This latest flash crash is distinct – it has occurred in the absence of news.Barry Ritholtz highlighted this chart in his blog post on May 1, 2018 for The Big Picture. I suggest reading Barry's post and Eric's original post at M&G's Episode blog.

Summary

Price action, according the the Ivy Portfolio, shows three ETFs invested and two in cash. Sentiment is improving, but remains fearful. As we've discussed for months valuations remain high. The VIX spike earlier this year is another risk factor for the market. If the market's valuation fascinates you, read Mark Hulbert's opinion piece published at MarketWatch on April 20, 2018. Remember overvalued markets can remain overvalued for a considerable amount of time and are a poor market timing indicator for the short-term direction of the market. Finally let's remember where we are in the election cycle. Since 1950 the S&P 500 has performed worse in May during midterm years than non-midterm years. During midterm election years the S&P 500 typically lost 0.9% in the month versus an overall average gain of 0.2%. For more on this pattern read Mark Hulbert's article: Opinion: These two stock market patterns add up to trouble for investors through election day. Let's end today's post with a quote from author Neil Gaiman:

"The world always seems brighter when you've just made something that wasn't there before."

As always, wise investing my friends.

Please consult a qualified financial advisor before making any investment decisions. This blog is for educational purposes only and does NOT constitute individual investment advice.--------------------------------------------------------

Here's what I've been watching and reading recently:

- Brian Belski Says Energy Stocks May Be a Profit-Taking Opportunity (Bloomberg)

- Hoisington Quarterly Review and Outlook, First Quarter 2018 (Hoisington)

- Bank of Canada chief issues household debt warning (MarketWatch)

- A Small College’s Endowment Manager Beat Harvard With Index Funds (Bloomberg)

- Opinion: Guess which of these S&P 500 valuation measures is telling the truth (MarketWatch)

- Neil Howe: Is Consumer Confidence Predicting a Downturn? (Hedgeye)

- Almost a Year in the Making: Dollar Closes Above 200-DMA (Bespoke)